What is Fobi.AI?

How do you describe a company like Fobi.AI (TSXV:FOBI.V)? It is always difficult to classify a business that has its hands in so many different cookie jars. At its core, Fobi is a specialist in enterprise digital transformation. It helps companies achieve a strong connection with its customers through the use of technology and data intelligence. Let’s call it part Palantir (NYSE:PLTR), part Salesforce.com (NYSE:CRM), and part Zendesk (NYSE:ZEN).

Fobi is a relatively young company having been established in 2019 in Vancouver, British Columbia. But in those three years, the company has been aggressive in its technology innovation and has its roots in all of the major global trends including blockchain, artificial intelligence, big data, and digital payments. Although Fobi works with partners around the world, the company is dedicated to improving customer-facing technology with local initiatives and implementing digital transformation in its home Province.

Fobi.AI Stock Analysis

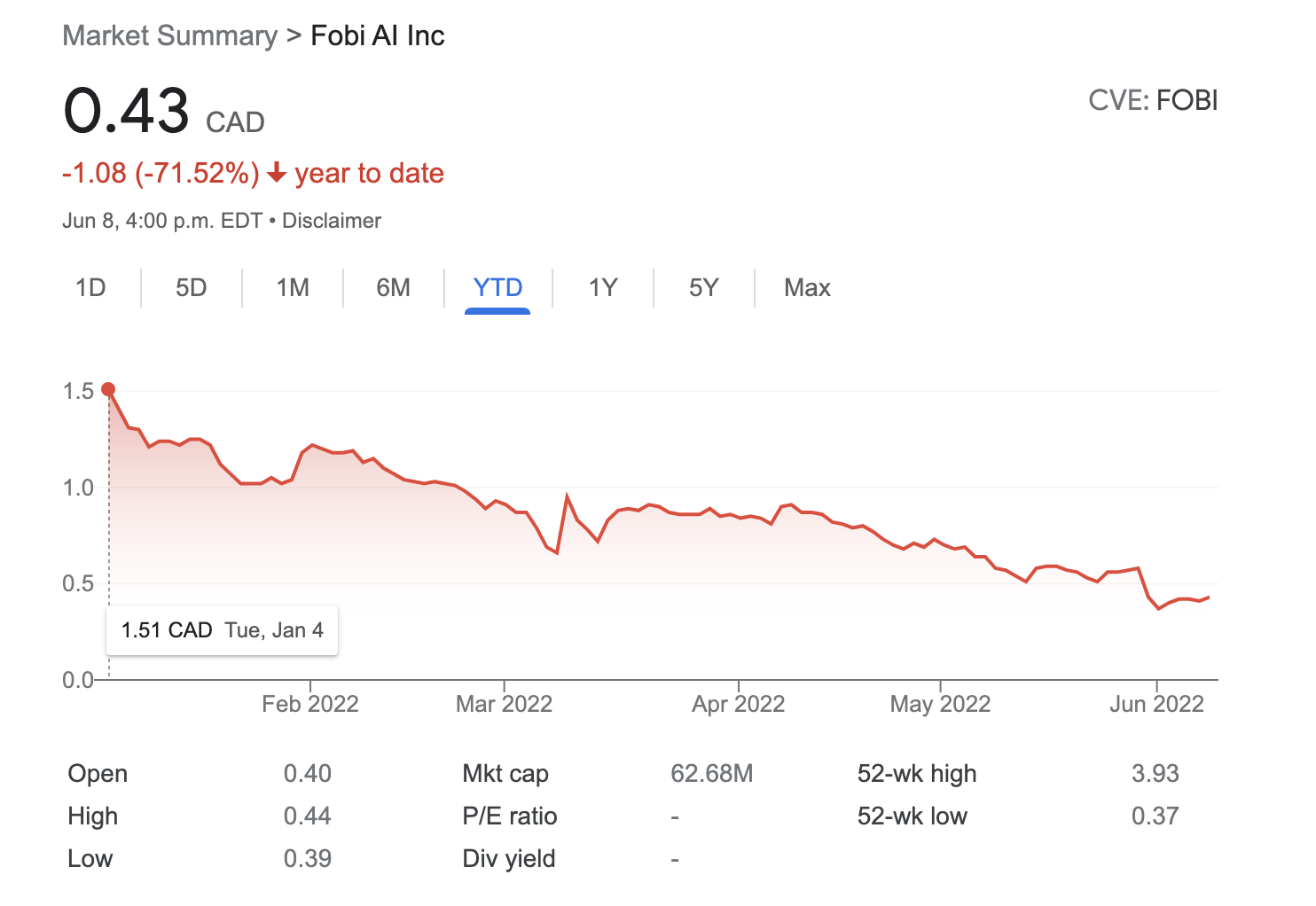

Fobi trades on the TSX Venture Exchange, which is similar to Canada’s version of the OTC markets. To be clear, Fobi is a penny stock pure and simple. If you are an investor who is more risk-averse, then investing in the TSX Venture Exchange usually isn’t recommended. As you can see from Fobi’s chart, 2022 has not been a friendly year for shareholders. The stock is down more than 70% year to date. Fobi is trading just above its 52-week low price of $0.37 per share and is well off of its 52-week high price of $3.93 per share which it hit in September 2021.

Fobi’s stock chart is a difficult one to analyze. For the year, it appears to be forming a classic head and shoulders formation. Like most stocks, the past few months have seen Fobi forming a bearish downtrend with lower highs and lower lows. At this point, it seems that the stock will need to once again find support at its 52-week low price level. Fobi is trading well below both its key 50-day and 200-day moving averages which further supports the bearish sentiment around the stock.

Fobi’s Business Solutions

Fobi clearly separates its business into three distinct segments: Connect & Analyze, Activate & Engage, and Access & Health. Much of the company’s proprietary technology and consumer-facing software services fall into these three main categories. Within these categories are the main industries in which Fobi operates including healthcare, eCommerce, and insurance. Let’s take a closer look at the services Fobi provides in these areas, and how much potential it has for the future.

Connect & Analyze

No matter how you operate your business, Fobi has a solution for you. Fobi’s IoT or Internet of Things device is at the heart of the company’s data intelligence services. Whether you are a brick-and-mortar store, an online business, or somewhere in between, Fobi will provide its data analysis tools via an on-prem or cloud-based solution.

Okay, that all sounds great but what does Fobi 3.0 actually do for you? The software helps to connect disparate data points within your business by using artificial intelligence and machine learning. This allows you to maximize your company’s potential by eliminating inefficiencies and streamlining your business process. Translation: focus on making money and let Fobi take care of the rest.

You might be wondering if businesses are actually using this data. Data intelligence and analytics are often referred to as the currency of the future. All it takes is to understand how much big tech companies value customer data to know how big this industry will be. Analyzing data trends allows businesses and its leaders to be agile. It isolates deficiencies within the business and provides predictable trends from customer history, behavior, as well as market and environmental data.

Activate & Engage

In this segment, Fobi focuses on the rapidly growing market for digital payments and wallets. While estimates fluctuate, some research analysts forecast the global digital wallet market to be valued at upwards of $750 billion by 2028. In terms of potential growth, this is one of the global secular trends that is here to stay. For any legitimate payment company, digital wallets and mobile payments are already the norm in many regions of the world, as we move further away from a cash-based society.

Fobi has three main products that it offers to its clients: Pass Pro, Passcreator, and Qples. Pass Pro is a digital wallet interface that can be fully customized to meet your business’ needs. Connect with your customers and provide exclusive products and services within the Pass Pro digital ecosystem. Fobi even has usable templates for businesses if you can’t decide how you want your app to function. Choose from a digital version of your insurance, a digital health and medical file which can include vaccine status, and even a restaurant app that can make reservations and redeem exclusive promotions.

Passcreator is Fobi’s fully customizable wallet solution. Rather than building your own mobile wallet, Passcreator can integrate your business’ digital pass or membership cards directly into both the Android or Apple Wallets. The Passcreator program creates dynamic wallet passes that can be created without needing to hire a team of software developers with a system that is flexible enough to add user details in up to 40 different languages.

Finally, ignore the quirky name because Qples is Fobi’s digital solution to eliminating paper coupons. The Qples platform allows you to create your own digital coupons which you can distribute directly to your customer’s mobile phones. It’s a simple platform to use, but in this digital age, mobile coupons are extremely effective. Some major brands that are already using the Qples software include Voss Water, Georgia Pacific, and Coconut Bliss.

As with most of Fobi’s products, all three of these platforms come with full, real-time data analytics so you can visualize how effectively you are reaching your customers. In terms of potential, it is much easier to see a path for sustainable growth in the Pass Pro and Passcreator than with Qples. While digital coupons target a niche market of consumers, digital wallets are rapidly becoming the predominant form of payment and identification in most developed countries.

Access & Health

Fobi is also aiming to take event management into the digital age with several products that focus on improving guest experience and operational efficiencies. Most notably, Fobi has created Checkpoint which is an end to end solution for registration, ticketing, and check-in at events and venues. Checkpoint streamlines the entire process, to the point where guests simply have to download the event ticket directly to their mobile wallet and tap in when they arrive at the venue.

Fobi has several other contactless healthcare solutions such as Smart Vital, which is an innovative way for checking against the threat of infectious diseases right from a user’s smartphone. Kai Care is a wallet pass technology where test results can be uploaded directly to a mobile wallet. This allows users to be screened for diseases such as COVID-19, and provides businesses with an innovative way to perform access management for events. Finally, CheckVax is exactly as it sounds: adding vaccination status directly to your mobile wallet.

Healthcare is a difficult industry to analyze in terms of future potential as each country, and often each State or Province, governs it in their own way. While the use cases for Kai Care and Smart Vital might have been necessary during the pandemic, it seems less relevant now as mandates are lifted. In the case of a future pandemic, we can certainly see these technologies being used again, but of course, this is impossible to predict and nearly impossible to bake into a company’s long-term growth forecast.

Checkpoint is the meal ticket here for Fobi, and indeed those who follow the company are already aware that it has already signed several major partnerships. Most recently, Fobi signed a contract for a major US Stock exchange to use Checkpoint to securely control who gains access to the venue. Checkpoint was also used earlier this year at a prestigious awards show to allow for contactless entry and identity confirmation at the high-security event. It is easy to see a path to success for Checkpoint, as the digital identification market continues to grow.

Data Analytics is the Heart of Fobi’s Business

Despite all of the technology we just mentioned, the heart and soul of Fobi’s business is its data analytics and intelligence services. The keen observer will notice that while Fobi offers a wide range of services to its clients, the true value in the product lies in the data intelligence that comes with most of Fobi’s technology. At the end of the day, Fobi owns several different proprietary pieces of technology and utilizes it for different purposes.

As a business, data analysis is the substance you want. It is the necessary information from your own business, your customers, and the market itself, that will help you find success in the long-term. Any developer can build a technology, but being able to analyze and understand how that technology is helping, or hurting, your business is the true benefit. Everything that Fobi sets out to do, whether it is improving customer relationships or implementing digital transformation, revolves around its ability to take a set of data and provide a business with a specific road to improvement.

Is Fobi.AI a Good Investment?

At the end of the day, as investors we analyze and research companies because we want to determine if they will be a good investment five, ten, or twenty years from now. Where does Fobi.AI go from here? Let’s start with where it is currently at. In the fiscal year 2021, Fobi had total revenues of $157,549 and reported an operating loss of more than $11 million. While SaaS companies often operate at a loss for years until they become profitable, Fobi’s valuations leave a lot to be desired. Even at its current depressed stock price, Fobi is trading with a price to sales ratio above 60. That is a fairly rich valuation even for a SaaS company that is in hyper-growth mode.To be fair, Fobi did report Q2 FY2022 revenues of $922,823 which is up from $580,317 in Q1. This shows excellent sequential revenue growth which is a sign that the company is on the right track to long-term profitability. As investors, this is definitely a positive outlook for Fobi’s stock.

As a SaaS company it does have the right growth model in mind. Establishing its proprietary solutions and selling them directly to other businesses where Fobi will collect onboarding fees as well as monthly fees for each active Wallet pass will bring in some nice recurring revenue streams. The key to remaining a successful SaaS company is to make it difficult for your customers to leave your ecosystem. Investors want this ecosystem to be ‘sticky’, and this is where Fobi needs to differentiate itself from its competition. It already has prestigious partnerships with publicly traded companies like Shopify (NYSE:SHOP), Lightspeed (NYSE:LSPD), Block (NYSE:SQ), and Oracle (NYSE:ORCL), while also working with MGM Resorts International and the NCAA.

It is clear that global companies know who Fobi is. But that isn’t always an indication that it has the best products on the market. With the mobile wallet space growing as fast as it is, Fobi is going to continue to see competition not just from local and domestic companies, but global rivals as well. Still, revenue and sales growth are the catalysts for company growth, and as those subscriptions and monthly fees continue to flow in, valuation multiples for Fobi’s stock will shrink. Fobi seems to have everything in place to sustain enterprise growth in the coming years, but it needs to prove to the world that its product and service offerings are strong enough to compete on a global scale. The potential is there for a great investment, especially at its currently discounted price, but Fobi needs to continue to execute if it wants to become a major player in the digital wallet industry.