MicroVision (NASDAQ:MVIS) is still up for sale, at least according to the company’s latest 10-Q report. The reason is pretty simple. It still only has one customer for its Lidar products. And that is on a royalty revenue basis. This leaves MVIS stock fairly overvalued at the present time.

I have written about this somewhat odd situation in the past several months. I argued that given that MicroVision is up for sale, and there are no takers, MVIS stock is likely to fall. The stock had a recent peak of $22.58 at close on June 10, a few days before my prior article, and it is down 45.6% to $12.28 as of the close of Sept. 24. However, given that MVIS still has a massive market value of over $2.09 billion, with annual revenue forecast to be just $3.63 million, it is simply too high.

Strategic Alternatives for MicroVision

Management has made it clear in both its quarterly filings and even as recent as Aug. 4, when it released its latest earnings and had a conference call. However, given that it has been able to raise some more cash in the past several months, it appears that the company is looking to do more than just a sale.

At the end of the first quarter the company reported that it had $75 million in cash, and as of June 30, it had $135.3 million. This was very smart on the part of the company. That is because MicroVision is still using a lot of cash. It was also a way for management to take advantage of its huge $2 billion market valuation.

Here is the fundamental problem as stated in the Management Statement section (page 6) of its 10-Q :

“However, while we do have a customer for one of these products which generates royalty income, the volume of sales and resulting royalties from that product are not significant, and we have been unable to secure additional customers to launch one of our products.”

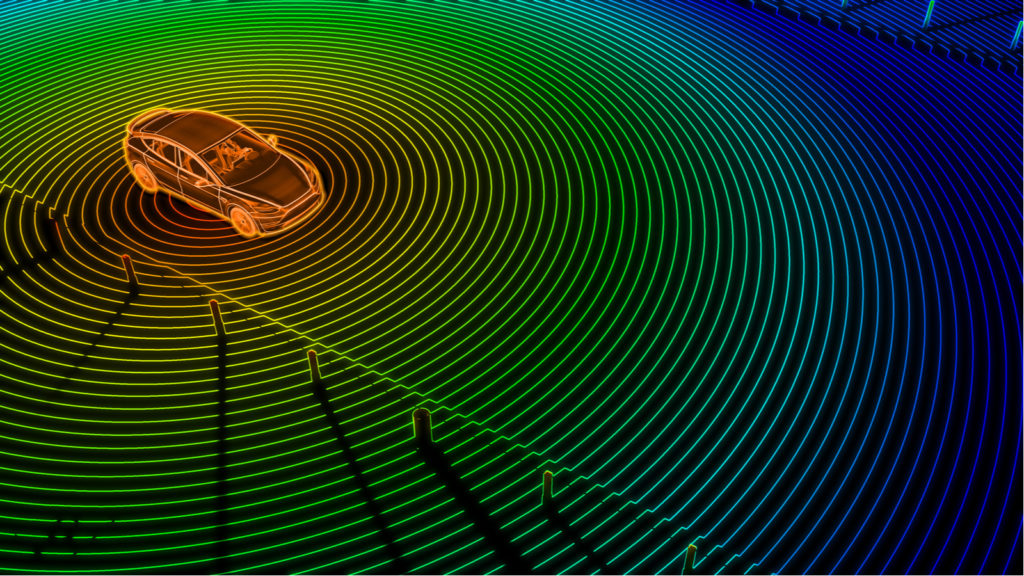

The company has great Lidar technology but only one customer. They want to be part of a larger group, such as an automobile company or a software company. In fact, they are now willing to do a joint venture and other types of strategic options:

“As a result, since February 2020, we have been simultaneously seeking strategic alternatives, including a potential sale or merger of the Company, sale of part of the Company, strategic minority investment, licensing agreement or other transaction, while continuing to develop our 1st Generation Long Range Lidar module.”

Management more or less confirmed this during the latest conference call. The CFO stated in the conference call:

“… we currently have no agreements or commitments to engage in any specific strategic transaction.”

Where This Leaves Investors in MVIS Stock

In the last six months, MicroVision lost $21.19 million on a net income basis. However, from a cash statement, the operating cash flow loss was $11.277 million, and from a free cash flow (FCF) standpoint, the loss was $13.161 million. This is because there was an additional $1.884 million in capital expenditures made during the period.

At this rate, the company will bleed through $26 million annually, although I believe that this will trend closer to $30 as capex and operating costs rise. Given that the company has $135 million in the bank, it can last four to five years with this cash burn rate without having to raise more cash.

What To Do With MVIS Stock

Seeking Alpha shows there are 2 analysts who cover the stock on Wall Street. There is no stock price target given. Yahoo! Finance shows that 3 analysts cover the stock, but their initial “buy” recommendations were in 2016 or 2017. Don’t count on them to write about the stock anytime soon.

The problem the company has is its technology is very advanced, but it’s not surprising that it has only one customer. Every company in the auto sector is looking for a way to make its vehicles look impressive and unique, and Lidar isn’t so compelling that everyone wants it.

Therefore, I suggest that most investors might want to wait for the stock to fall a good way further before investing in MVIS stock. At the present time, it’s hardly a bargain even after dropping in price.

On the date of publication, Mark R. Hake did not own any security mentioned in the article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Mark Hake writes about personal finance on mrhake.medium.com and runs the Total Yield Value Guide which you can review here.